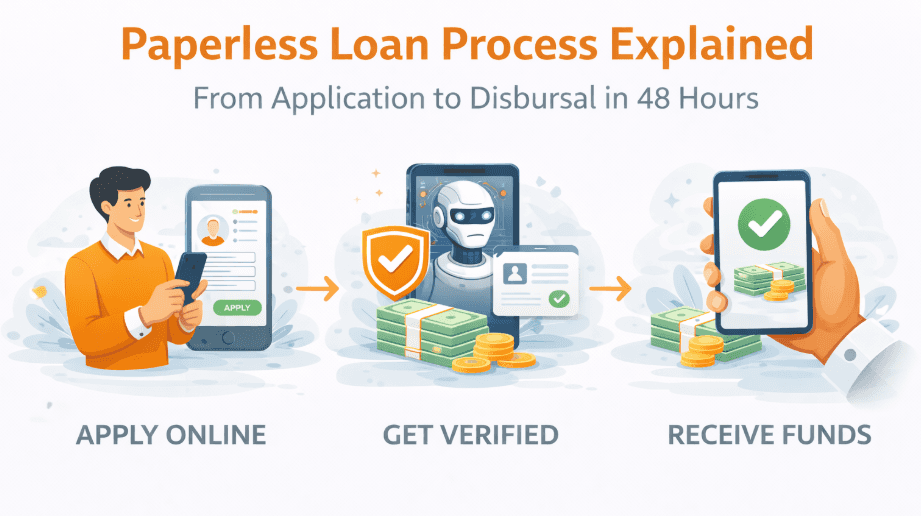

Paperless Loan Process: From Application to Disbursal in 48 Hrs

|

Waiting weeks for a loan approval is no longer the norm in India. In 2026, the paperless loan process has transformed how borrowers access credit, making it possible to move from application to disbursal within 48 hours. Powered by AI, digital KYC, and real-time data verification, paperless lending eliminates branch visits, physical documents, and long follow-ups. At Saarathi.ai, we have observed that borrowers using fully digital journeys experience faster approvals, clearer communication, and fewer rejections compared to traditional methods. This guide explains the paperless loan process step by step, helping you understand how modern lending works and what you can do to ensure quick disbursal.

What Is a Paperless Loan Process

A paperless loan process is a fully digital lending journey where applications, verification, approval, and disbursal happen online. Instead of submitting physical documents, borrowers upload digital copies or allow secure data access through consent-based systems. AI and automation handle eligibility checks, credit assessment, and document validation. In 2026, this approach has become mainstream across personal loans, business loans, home loans, and loan against property.

Why Paperless Loans Are Faster

The biggest reason paperless loans are faster is automation. Manual data entry, physical verification, and branch coordination are replaced with real-time systems. Digital KYC, bank statement analysis, and credit bureau checks happen instantly. According to digital lending frameworks aligned with the Reserve Bank of India, regulated lenders are encouraged to adopt transparent and secure digital processes. This has reduced approval timelines from weeks to hours in many cases.

Step 1: Online Loan Application

The paperless journey begins with a simple online application. Borrowers enter basic details such as income, employment type, loan amount, and purpose. AI-driven forms adapt based on borrower profile, reducing unnecessary questions. At Saarathi.ai, borrowers can apply once and access offers from 110+ banks and NBFCs without filling multiple forms. This single-window approach saves time and reduces errors.

Step 2: Instant Eligibility Check

Once details are submitted, AI systems perform instant eligibility checks. Credit score, income stability, and repayment capacity are evaluated within seconds. Borrowers receive immediate feedback on eligible loan amount, estimated interest rates, and tenure options. This upfront clarity helps borrowers avoid rejections and protects credit health by limiting unnecessary hard inquiries.

Step 3: Digital KYC and Identity Verification

Digital KYC is a cornerstone of paperless lending. Aadhaar-based eKYC, video KYC, and PAN verification allow lenders to confirm identity remotely. Borrowers simply upload documents or complete a short video process. AI tools verify authenticity and flag discrepancies in real time. In most cases, KYC is completed within minutes, eliminating the need for physical presence.

Step 4: Document Upload and AI Verification

Instead of submitting bulky files, borrowers upload scanned copies or PDFs of required documents. These typically include bank statements, income proof, and business documents for MSMEs. AI-powered document intelligence extracts data, checks consistency, and validates information against trusted sources. At Saarathi.ai, document requirements are clearly communicated upfront, helping borrowers prepare in advance and avoid delays.

Step 5: Credit Assessment and Lender Matching

This is where AI adds maximum value. Advanced models analyse cash flows, repayment behaviour, and financial patterns rather than relying only on a single credit score. The Saarathi Recommendation Engine matches borrower profiles with lenders most likely to approve quickly and offer competitive terms. This personalised matching significantly improves approval speed and success rates.

Step 6: Offer Comparison and Selection

Borrowers receive multiple loan offers with clear details on interest rates, EMIs, tenure, processing fees, and prepayment terms. Instead of negotiating offline, borrowers can compare offers transparently on the Saarathi Bazaar dashboard. This step empowers borrowers to choose the best option without pressure or confusion.

Step 7: Digital Agreement and e-Sign

Once an offer is selected, the loan agreement is shared digitally. Borrowers review terms and sign electronically using e-sign or OTP-based authentication. This replaces physical agreements and courier delays. Digital agreements are legally valid and securely stored, ensuring compliance and convenience.

Step 8: Disbursal Within 48 Hours

After agreement execution, funds are disbursed directly to the borrower’s bank account. For many personal and business loans, this happens within 24 to 48 hours of application. The exact timeline depends on loan type and lender, but paperless processes have dramatically reduced waiting time. Saarathi.ai keeps borrowers informed at every stage with real-time status updates.

Who Benefits Most From Paperless Loans

Paperless loans benefit salaried professionals, self-employed individuals, and MSMEs alike. Salaried borrowers enjoy faster personal loan approvals. MSMEs benefit from cash flow-based assessment using GST and bank data. First-time borrowers gain clarity and guidance through AI experts, reducing anxiety and errors.

Common Mistakes That Delay Paperless Loans

Even digital processes can face delays if borrowers make mistakes. Uploading unclear documents, providing inconsistent information, or applying for unrealistic loan amounts can slow approvals. Applying to multiple lenders separately can also harm credit scores. Using a single trusted platform like Saarathi.ai helps avoid these issues.

Security and Data Privacy Considerations

Paperless lending relies on secure technology. Reputed platforms use encryption, consent-based data sharing, and RBI-compliant practices. Borrowers should always ensure they are dealing with regulated lenders and trusted marketplaces. Saarathi.ai works only with verified banks and NBFCs, prioritising data safety and transparency.

What the Future Holds

Paperless lending will continue to evolve with voice-based applications, regional language support, and predictive credit offers. In 2026, the focus is on responsible speed, ensuring borrowers get quick access to credit without compromising fairness or security.

FAQs

Can I really get a loan in 48 hours?

Yes. Many personal and business loans are approved and disbursed within 24 to 48 hours through paperless processes.

Is paperless lending safe?

Yes, when done through RBI-regulated lenders and secure platforms.

Do paperless loans cost more?

Not necessarily. Transparent comparison often helps borrowers find competitive rates.

What documents are usually required?

Basic KYC, bank statements, and income or business proof, all uploaded digitally.

Does paperless mean no verification?

Verification still happens, but it is digital, faster, and more accurate.

Conclusion

The paperless loan process in 2026 has made borrowing faster, simpler, and more transparent than ever before. Key benefits include instant eligibility checks, minimal documentation, AI-driven approvals, and disbursal within 48 hours. For borrowers who value speed without sacrificing trust, digital lending is the clear choice. Compare personalised loan offers, track your application in real time, and experience a truly paperless journey from start to finish on Saarathi.ai today.