Trusted by 1,00,000+ Borrowers

Your dream deserves a Saarathi

Compare and find the right loan through a fast, hassle-free digital process.

Trusted by 1,00,000+ Borrowers

Your dream deserves a Saarathi

Compare and find the right loan through a fast, hassle-free digital process.

Shalini received a ₹1 Cr offer within 11 minutes

Rahul got offers from 6 top lenders

Anjali closed a ₹40L Personal Loan

Vikram just matched with 8 lenders for a Home Loan

Sunita received a ₹30L offer within 12 minutes

Sneha got offers from 8 top lenders

Suresh closed a ₹2 Cr Loan Against Property

Harsh just matched with 5 lenders for a Personal Loan

Priya received a ₹45L offer within 8 minutes

Pankaj got offers from 5 top lenders

Mehul closed a ₹60L Home Loan

Deepak received a ₹1.8 Cr offer within 14 minutes

Meera got offers from 4 top lenders

Aakash just matched with 4 lenders for a Business Loan

Jyoti received a ₹70L offer within 13 minutes

Ritu got offers from 9 top lenders

Siddharth closed a ₹1.5 Cr Home Loan

Sandeep just matched with 4 lenders for a Business Loan

Kiran closed a ₹35L Personal Loan

Manoj received a ₹90L offer within 9 minutes

Shreya just matched with 5 lenders for a Home Loan

Vikas received a ₹2.5 Cr offer within 15 minutes

Nitin got offers from 6 top lenders

Amitabh closed a ₹20L Business Loan

Tanvi just matched with 4 lenders for a Home Loan

Kavita received a ₹25L offer within 7 minutes

Preeti closed a ₹50L Business Loan

Rohit just matched with 6 lenders for a Business Loan

Bhavesh just matched with 5 lenders for a Loan Against Property

Gaurav got offers from 7 top lenders

Ramesh received a ₹1.2 Cr offer within 10 minutes

Neha just matched with 7 lenders for a Home Loan

Kunal got offers from 5 top lenders

Pooja closed a ₹75L Business Loan

Ankit just matched with 6 lenders for a Personal Loan

Shalini received a ₹1 Cr offer within 11 minutes

Rahul got offers from 6 top lenders

Anjali closed a ₹40L Personal Loan

Vikram just matched with 8 lenders for a Home Loan

Sunita received a ₹30L offer within 12 minutes

Sneha got offers from 8 top lenders

Suresh closed a ₹2 Cr Loan Against Property

Harsh just matched with 5 lenders for a Personal Loan

Priya received a ₹45L offer within 8 minutes

Pankaj got offers from 5 top lenders

Mehul closed a ₹60L Home Loan

Deepak received a ₹1.8 Cr offer within 14 minutes

Meera got offers from 4 top lenders

Aakash just matched with 4 lenders for a Business Loan

Jyoti received a ₹70L offer within 13 minutes

Ritu got offers from 9 top lenders

Siddharth closed a ₹1.5 Cr Home Loan

Sandeep just matched with 4 lenders for a Business Loan

Kiran closed a ₹35L Personal Loan

Manoj received a ₹90L offer within 9 minutes

Shreya just matched with 5 lenders for a Home Loan

Vikas received a ₹2.5 Cr offer within 15 minutes

Nitin got offers from 6 top lenders

Amitabh closed a ₹20L Business Loan

Tanvi just matched with 4 lenders for a Home Loan

Kavita received a ₹25L offer within 7 minutes

Preeti closed a ₹50L Business Loan

Rohit just matched with 6 lenders for a Business Loan

Bhavesh just matched with 5 lenders for a Loan Against Property

Gaurav got offers from 7 top lenders

Ramesh received a ₹1.2 Cr offer within 10 minutes

Neha just matched with 7 lenders for a Home Loan

Kunal got offers from 5 top lenders

Pooja closed a ₹75L Business Loan

Ankit just matched with 6 lenders for a Personal Loan

Shalini received a ₹1 Cr offer within 11 minutes

Rahul got offers from 6 top lenders

Anjali closed a ₹40L Personal Loan

Vikram just matched with 8 lenders for a Home Loan

Sunita received a ₹30L offer within 12 minutes

Sneha got offers from 8 top lenders

Suresh closed a ₹2 Cr Loan Against Property

Harsh just matched with 5 lenders for a Personal Loan

Priya received a ₹45L offer within 8 minutes

Pankaj got offers from 5 top lenders

Mehul closed a ₹60L Home Loan

Deepak received a ₹1.8 Cr offer within 14 minutes

Meera got offers from 4 top lenders

Aakash just matched with 4 lenders for a Business Loan

Jyoti received a ₹70L offer within 13 minutes

Ritu got offers from 9 top lenders

Siddharth closed a ₹1.5 Cr Home Loan

Sandeep just matched with 4 lenders for a Business Loan

Kiran closed a ₹35L Personal Loan

Manoj received a ₹90L offer within 9 minutes

Shreya just matched with 5 lenders for a Home Loan

Vikas received a ₹2.5 Cr offer within 15 minutes

Nitin got offers from 6 top lenders

Amitabh closed a ₹20L Business Loan

Tanvi just matched with 4 lenders for a Home Loan

Kavita received a ₹25L offer within 7 minutes

Preeti closed a ₹50L Business Loan

Rohit just matched with 6 lenders for a Business Loan

Bhavesh just matched with 5 lenders for a Loan Against Property

Gaurav got offers from 7 top lenders

Ramesh received a ₹1.2 Cr offer within 10 minutes

Neha just matched with 7 lenders for a Home Loan

Kunal got offers from 5 top lenders

Pooja closed a ₹75L Business Loan

Ankit just matched with 6 lenders for a Personal Loan

Shalini received a ₹1 Cr offer within 11 minutes

Rahul got offers from 6 top lenders

Anjali closed a ₹40L Personal Loan

Vikram just matched with 8 lenders for a Home Loan

Sunita received a ₹30L offer within 12 minutes

Sneha got offers from 8 top lenders

Suresh closed a ₹2 Cr Loan Against Property

Harsh just matched with 5 lenders for a Personal Loan

Priya received a ₹45L offer within 8 minutes

Pankaj got offers from 5 top lenders

Mehul closed a ₹60L Home Loan

Deepak received a ₹1.8 Cr offer within 14 minutes

Meera got offers from 4 top lenders

Aakash just matched with 4 lenders for a Business Loan

Jyoti received a ₹70L offer within 13 minutes

Ritu got offers from 9 top lenders

Siddharth closed a ₹1.5 Cr Home Loan

Sandeep just matched with 4 lenders for a Business Loan

Kiran closed a ₹35L Personal Loan

Manoj received a ₹90L offer within 9 minutes

Shreya just matched with 5 lenders for a Home Loan

Vikas received a ₹2.5 Cr offer within 15 minutes

Nitin got offers from 6 top lenders

Amitabh closed a ₹20L Business Loan

Tanvi just matched with 4 lenders for a Home Loan

Kavita received a ₹25L offer within 7 minutes

Preeti closed a ₹50L Business Loan

Rohit just matched with 6 lenders for a Business Loan

Bhavesh just matched with 5 lenders for a Loan Against Property

Gaurav got offers from 7 top lenders

Ramesh received a ₹1.2 Cr offer within 10 minutes

Neha just matched with 7 lenders for a Home Loan

Kunal got offers from 5 top lenders

Pooja closed a ₹75L Business Loan

Ankit just matched with 6 lenders for a Personal Loan

5+ Yrs

5+ Yrs

of Experience

5+ Yrs

of Experience

110+

110+

Lending Partners

90+

Lending Partners

1.0 Lakh+

1.0 Lakh+

Customer Served

1.0 Lakh+

Customer Served

Loan Products for Every Financial Need

Loans for Everyone, For Every Need

One platform. Multiple loan solutions.

End-to-End Digital Loan Experience

Expert Support at Every Step

100% Transparency, 0% Hidden-Fee

Loans Starting from 7.10%*

India’s Leading Banks & NBFCs on an single platform.

7.2% - 12.7%

HL

Aditya Birla Capital Home Finance

7.2% - 10.2%

HL

Bajaj Housing Finance Ltd

9.5% -20.0%

HL

CholamandalamInvestmentandFinanceLimited

9.9% - 20.0%

HL

DMI Housing Finance

7.9% - 13.2%

HL

HdfcBank

7.5% - 11.8%

HL

ICICI Bank

8.2% - 12.0%

HL

JioFinanceLimited

7.7% - 9.5%

HL

KotakMahindraBank

8.2% - 11.1%

HL

PnbHousingFinanceLtd

8.7% - 10.3%

HL

RblBankLimited

7.2% - 8.7%

HL

State Bank of India (SBI)

7.5% - 10.5%

HL

Tata Capital Housing Finance

10.7% - 22.5%

BL

Hdfc Bank

14.0% - 30.0%

BL

HeroFincorp

8.9% - 19.5%

BL

ICICI Bank

12.9% - 20.0%

BL

IdfcFirstBank

11.7% - 26.0%

BL

Kotak Mahindra Bank

15.0% - 24.0%

BL

L&T Finance

12.0% - 30.0%

BL

Tata Capital

8.6% - 16.5%

LAP

Aditya Birla Capital Home Finance LAP

8.5% - 11.0%

LAP

Bajaj Housing Finance Ltd

9.0% - 11.0%

LAP

Hdfc Bank

9.7% - 13.0%

LAP

ICICI Bank

9.2% - 12.5%

LAP

IDFC First Bank

9.1% - 12.5%

LAP

Kotak Mahindra Bank

8.7% - 12.0%

LAP

Pnb Housing Finance Ltd

10.2% - 13.5%

LAP

State Bank of India (SBI)

9.0% - 17.0%

LAP

Tata Capital Housing Finance

11.0% - 24.0%

PL

Aditya Birla Capital

10.9% - 24.7%

PL

Aditya Birla Capital

9.9% - 24.0%

PL

Hdfc Bank

10.4% - 16.5%

PL

ICICI Bank

9.9% - 24.0%

PL

IDFC First Bank

9.9% - 21.0%

PL

Kotak Mahindra Bank

10.9% - 18.5%

PL

Tata Capital

9.9% - 24.0%

PL

Hdfc Bank

9.9% - 24.0%

PL

IDFC First Bank

9.9% - 21.0%

PL

Kotak Mahindra Bank

9.9% - 20.0%

HL

DMI Housing Finance

9.7% - 13.0%

LAP

ICICI Bank

9.5% -20.0%

HL

CholamandalamInvestmentandFinanceLimited

9.2% - 12.5%

LAP

IDFC First Bank

9.1% - 12.5%

LAP

Kotak Mahindra Bank

9.0% - 17.0%

LAP

Tata Capital Housing Finance

9.0% - 11.0%

LAP

Hdfc Bank

8.9% - 19.5%

BL

ICICI Bank

8.7% - 12.0%

LAP

Pnb Housing Finance Ltd

8.7% - 10.3%

HL

RblBankLimited

8.6% - 16.5%

LAP

Aditya Birla Capital Home Finance LAP

8.5% - 11.0%

LAP

Bajaj Housing Finance Ltd

8.2% - 12.0%

HL

JioFinanceLimited

8.2% - 11.1%

HL

PnbHousingFinanceLtd

7.9% - 13.2%

HL

HdfcBank

7.7% - 9.5%

HL

KotakMahindraBank

7.5% - 11.8%

HL

ICICI Bank

7.5% - 10.5%

HL

Tata Capital Housing Finance

7.2% - 8.7%

HL

State Bank of India (SBI)

7.2% - 12.7%

HL

Aditya Birla Capital Home Finance

7.2% - 10.2%

HL

Bajaj Housing Finance Ltd

15.0% - 24.0%

BL

L&T Finance

14.0% - 30.0%

BL

HeroFincorp

12.9% - 20.0%

BL

IdfcFirstBank

12.0% - 30.0%

BL

Tata Capital

11.7% - 26.0%

BL

Kotak Mahindra Bank

11.0% - 24.0%

PL

Aditya Birla Capital

10.9% - 24.7%

PL

Aditya Birla Capital

10.9% - 18.5%

PL

Tata Capital

10.7% - 22.5%

BL

Hdfc Bank

10.4% - 16.5%

PL

ICICI Bank

10.2% - 13.5%

LAP

State Bank of India (SBI)

7.2% - 12.7%

HL

7.2% - 10.2%

HL

9.5% -20.0%

HL

9.9% - 20.0%

HL

7.9% - 13.2%

HL

7.5% - 11.8%

HL

8.2% - 12.0%

HL

7.7% - 9.5%

HL

8.2% - 11.1%

HL

8.7% - 10.3%

HL

7.2% - 8.7%

HL

7.5% - 10.5%

HL

10.7% - 22.5%

BL

14.0% - 30.0%

BL

8.9% - 19.5%

BL

12.9% - 20.0%

BL

11.7% - 26.0%

BL

15.0% - 24.0%

BL

12.0% - 30.0%

BL

8.6% - 16.5%

LAP

8.5% - 11.0%

LAP

9.0% - 11.0%

LAP

9.7% - 13.0%

LAP

9.2% - 12.5%

LAP

9.1% - 12.5%

LAP

8.7% - 12.0%

LAP

10.2% - 13.5%

LAP

9.0% - 17.0%

LAP

11.0% - 24.0%

PL

10.9% - 24.7%

PL

9.9% - 24.0%

PL

10.4% - 16.5%

PL

9.9% - 24.0%

PL

9.9% - 21.0%

PL

10.9% - 18.5%

PL

9.9% - 24.0%

PL

9.9% - 24.0%

PL

9.9% - 21.0%

PL

9.9% - 20.0%

HL

9.7% - 13.0%

LAP

9.5% -20.0%

HL

9.2% - 12.5%

LAP

9.1% - 12.5%

LAP

9.0% - 17.0%

LAP

9.0% - 11.0%

LAP

8.9% - 19.5%

BL

8.7% - 12.0%

LAP

8.7% - 10.3%

HL

8.6% - 16.5%

LAP

8.5% - 11.0%

LAP

8.2% - 12.0%

HL

8.2% - 11.1%

HL

7.9% - 13.2%

HL

7.7% - 9.5%

HL

7.5% - 11.8%

HL

7.5% - 10.5%

HL

7.2% - 8.7%

HL

7.2% - 12.7%

HL

7.2% - 10.2%

HL

15.0% - 24.0%

BL

14.0% - 30.0%

BL

12.9% - 20.0%

BL

12.0% - 30.0%

BL

11.7% - 26.0%

BL

11.0% - 24.0%

PL

10.9% - 24.7%

PL

10.9% - 18.5%

PL

10.7% - 22.5%

BL

10.4% - 16.5%

PL

10.2% - 13.5%

LAP

7.2% - 12.7%

HL

7.2% - 10.2%

HL

9.5% -20.0%

HL

9.9% - 20.0%

HL

7.9% - 13.2%

HL

7.5% - 11.8%

HL

8.2% - 12.0%

HL

7.7% - 9.5%

HL

8.2% - 11.1%

HL

8.7% - 10.3%

HL

7.2% - 8.7%

HL

7.5% - 10.5%

HL

10.7% - 22.5%

BL

14.0% - 30.0%

BL

8.9% - 19.5%

BL

12.9% - 20.0%

BL

11.7% - 26.0%

BL

15.0% - 24.0%

BL

12.0% - 30.0%

BL

8.6% - 16.5%

LAP

8.5% - 11.0%

LAP

9.0% - 11.0%

LAP

9.7% - 13.0%

LAP

9.2% - 12.5%

LAP

9.1% - 12.5%

LAP

8.7% - 12.0%

LAP

10.2% - 13.5%

LAP

9.0% - 17.0%

LAP

11.0% - 24.0%

PL

10.9% - 24.7%

PL

9.9% - 24.0%

PL

10.4% - 16.5%

PL

9.9% - 24.0%

PL

9.9% - 21.0%

PL

10.9% - 18.5%

PL

9.9% - 24.0%

PL

9.9% - 24.0%

PL

9.9% - 21.0%

PL

9.9% - 20.0%

HL

9.7% - 13.0%

LAP

9.5% -20.0%

HL

9.2% - 12.5%

LAP

9.1% - 12.5%

LAP

9.0% - 17.0%

LAP

9.0% - 11.0%

LAP

8.9% - 19.5%

BL

8.7% - 12.0%

LAP

8.7% - 10.3%

HL

8.6% - 16.5%

LAP

8.5% - 11.0%

LAP

8.2% - 12.0%

HL

8.2% - 11.1%

HL

7.9% - 13.2%

HL

7.7% - 9.5%

HL

7.5% - 11.8%

HL

7.5% - 10.5%

HL

7.2% - 8.7%

HL

7.2% - 12.7%

HL

7.2% - 10.2%

HL

15.0% - 24.0%

BL

14.0% - 30.0%

BL

12.9% - 20.0%

BL

12.0% - 30.0%

BL

11.7% - 26.0%

BL

11.0% - 24.0%

PL

10.9% - 24.7%

PL

10.9% - 18.5%

PL

10.7% - 22.5%

BL

10.4% - 16.5%

PL

10.2% - 13.5%

LAP

*Rates are indicative and subject to lender policies.

Plan your Loan Smarter

Use these Calculators to make informed financial decisions

EMI Cal.

Plan your repayments with precision.

Pre-Payment Cal.

Save on interest by paying early.

Balance Transfer Savings Cal.

Is switching banks worth it?

Loan Comparison Cal.

See the true cost of borrowing.

Pre-Pay Loan vs Investment Cal

Make the smarter capital choice.

EMI Cal.

Pre-Payment Cal.

Balance Transfer Savings Cal.

Loan Comparison Cal.

Pre-Pay Loan vs Investment Cal

Plan your repayments with precision.

Plan your repayments with precision. Calculate your accurate monthly EMI, view the detailed amortization schedule to track principal versus interest, and download the full report in Excel instantly.

“I didn’t have the energy to visit every bank. Saarathi Bazaar brought real loan offers to me.”

Jayshree Malik

Business Loan

“I didn’t have the energy to visit every bank. Saarathi Bazaar brought real loan offers to me.”

Jayshree Malik

Business Loan

“I was tired of banks giving no answers. Saarathi Bazaar gave clarity, direction, and likely offers fast.”

Ragendra Sharma

Home Loan

“I was tired of banks giving no answers. Saarathi Bazaar gave clarity, direction, and likely offers fast.”

Ragendra Sharma

Home Loan

“I unlocked funds without selling my property. One request reached multiple lenders with instant clarity.”

Manesh Dhar

Loan Against Mutual Fund

“I unlocked funds without selling my property. One request reached multiple lenders with instant clarity.”

Manesh Dhar

Loan Against Mutual Fund

“We wanted a home but didn’t know who’d lend. Saarathi Bazaar showed where we stood instantly.”

Manshi Malhotra

Home Loan

“We wanted a home but didn’t know who’d lend. Saarathi Bazaar showed where we stood instantly.”

Manshi Malhotra

Home Loan

“We bought our first shop confidently. Saarathi Bazaar simplified everything with one request and real options.”

Kisori Lal

Loan Against Property

“We bought our first shop confidently. Saarathi Bazaar simplified everything with one request and real options.”

Kisori Lal

Loan Against Property

“Har bank alag story sunata tha. Saarathi Bazaar ne eligibility aur best offers ek jagah dikha diye.”

Lucky Siddhu

Loan Against Properties

“Har bank alag story sunata tha. Saarathi Bazaar ne eligibility aur best offers ek jagah dikha diye.”

Lucky Siddhu

Loan Against Properties

“I didn’t have the energy to visit every bank. Saarathi Bazaar brought real loan offers to me.”

Jayshree Malik

Business Loan

“I was tired of banks giving no answers. Saarathi Bazaar gave clarity, direction, and likely offers fast.”

Ragendra Sharma

Home Loan

“I unlocked funds without selling my property. One request reached multiple lenders with instant clarity.”

Manesh Dhar

Loan Against Mutual Fund

“We wanted a home but didn’t know who’d lend. Saarathi Bazaar showed where we stood instantly.”

Manshi Malhotra

Home Loan

“We bought our first shop confidently. Saarathi Bazaar simplified everything with one request and real options.”

Kisori Lal

Loan Against Property

“Har bank alag story sunata tha. Saarathi Bazaar ne eligibility aur best offers ek jagah dikha diye.”

Lucky Siddhu

Loan Against Properties

A Unified Suite for Modern Lending

Powerful, tech-driven products designed to simplify sourcing, accelerate decisions, and

deliver seamless digital lending experiences across stakeholders.

Powerful, tech-driven products designed to simplify sourcing, accelerate decisions, and deliver seamless digital lending experiences across stakeholders.

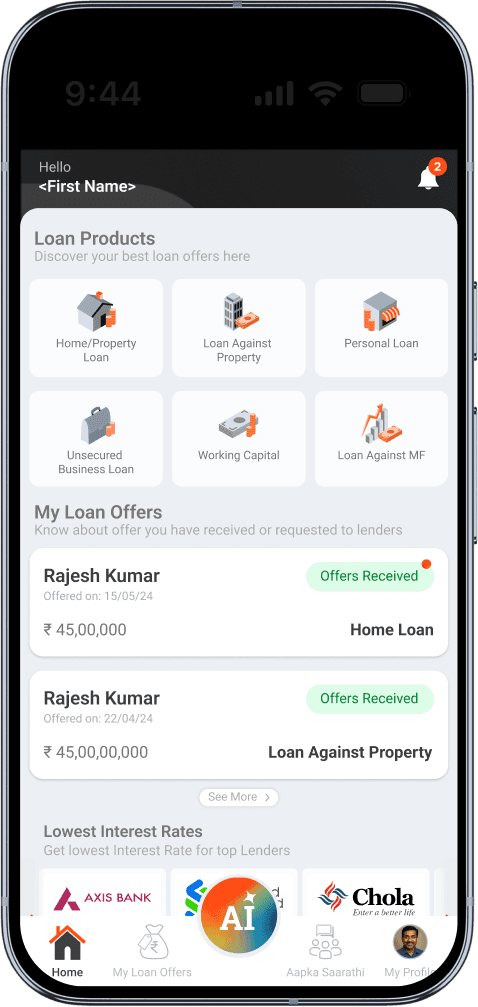

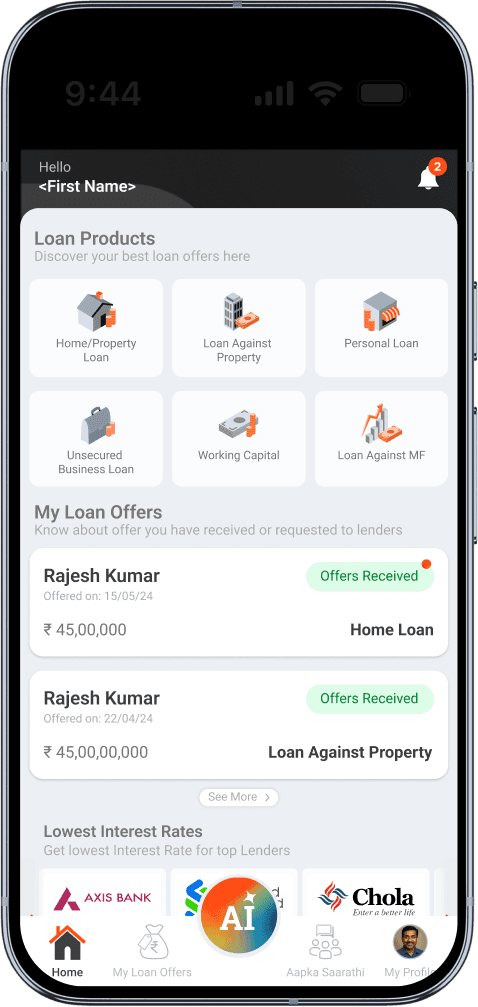

Saarathi Bazaar Dashboard

Your Loan Marketplace, All in One Place

Compare loan products, track loan Requests, and discover the best offers tailored to your profile, effortlessly.

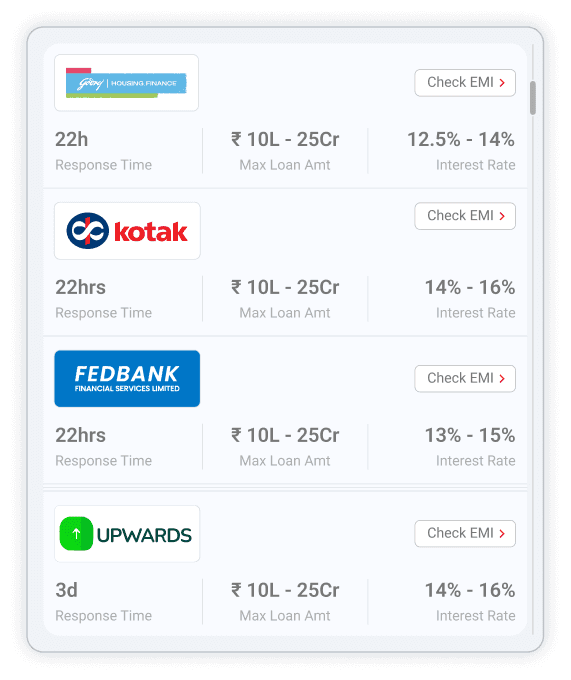

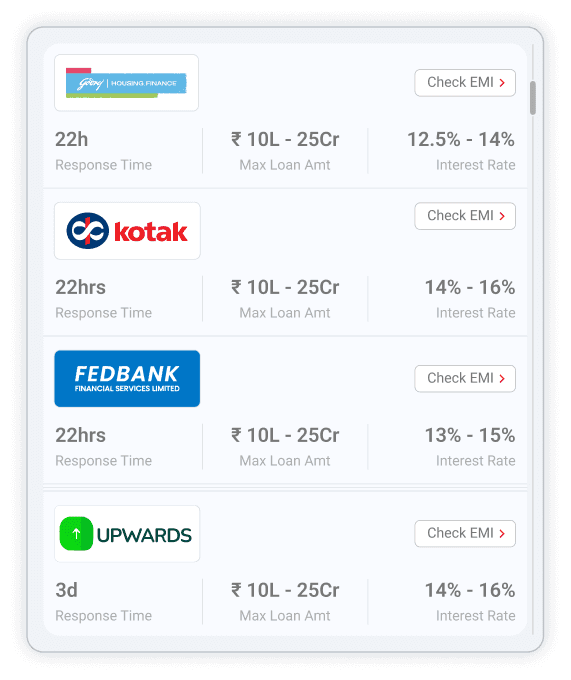

My Loan Offers

Your Loan Offers, Clearly Explained

See real loan offers from multiple lenders, compare terms easily, and take the next step with complete confidence.

Saarathi Recommendation Engine

Smart Lender Matches Based on Your Profile

Powered by data and similar borrower insights, Saarathi recommends lenders most likely to approve your loan, faster and smarter.

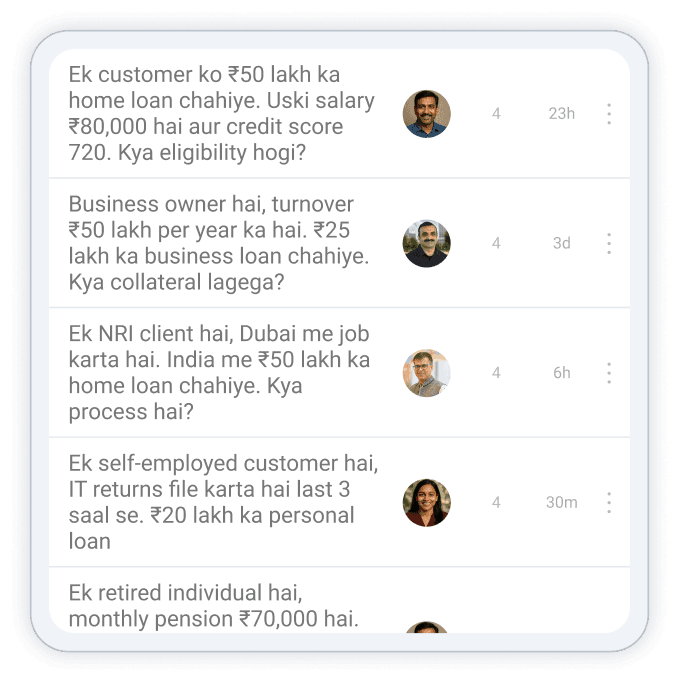

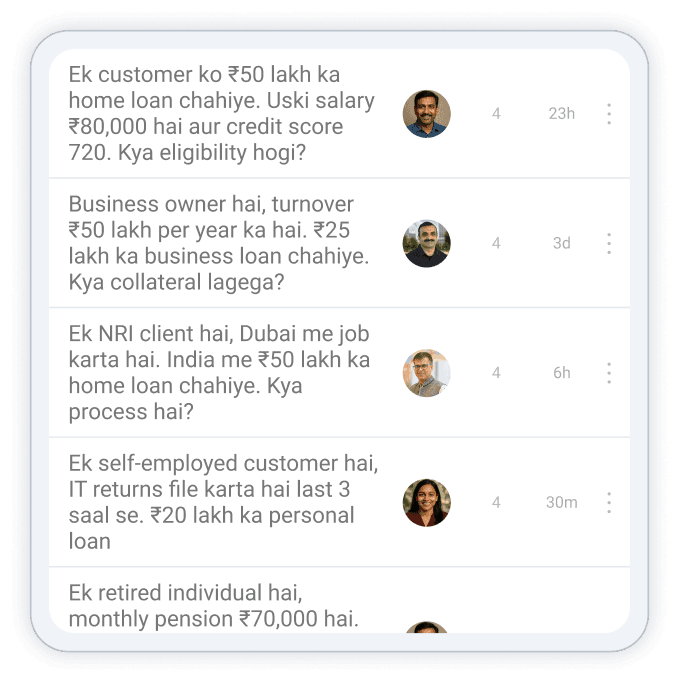

Aapka Saarathi

Ask Questions. Get Answers. Learn from Experts.

Have a loan question? Join the Saarathi community to ask loan-related questions and get trusted answers from financial experts and experienced partners.

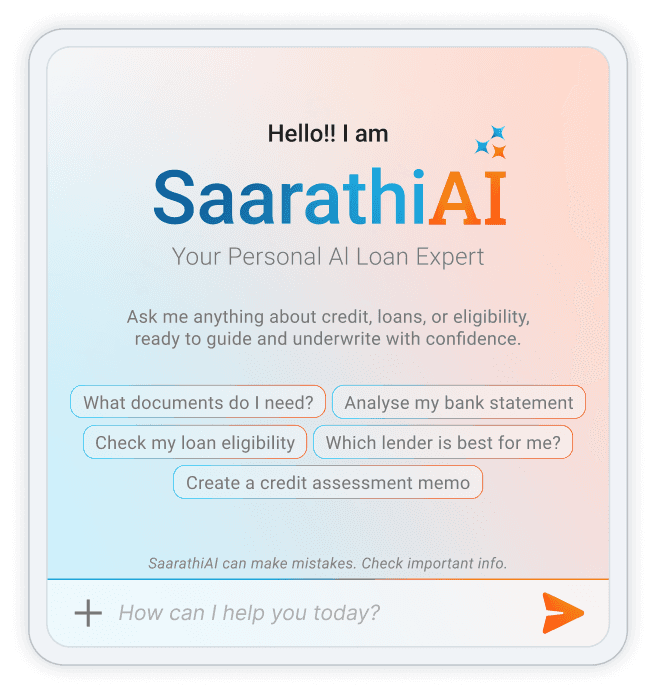

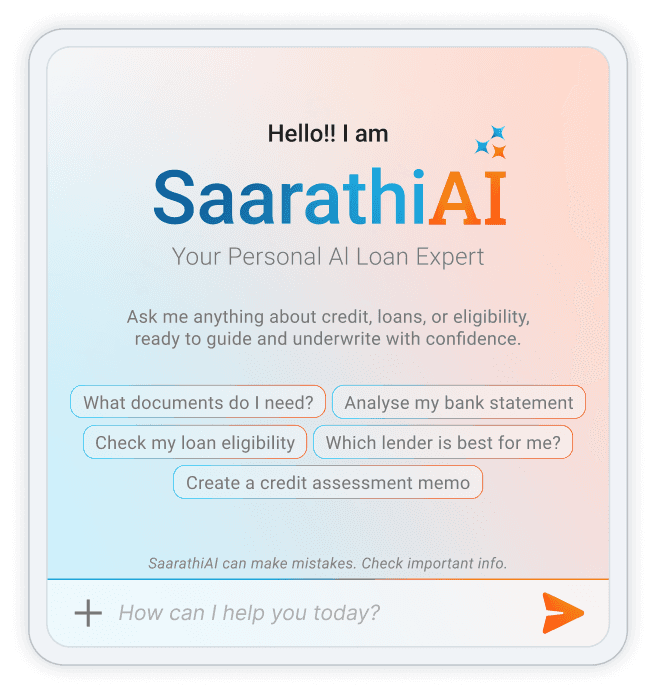

Saarathi AI

Your Personal AI Loan Expert

Ask SaarathiAI anything about loans, eligibility, credit, or documents — and get instant, guided answers you can trust.

Saarathi Bazaar Dashboard

Your Loan Marketplace, All in One Place

Compare loan products, track loan Requests, and discover the best offers tailored to your profile, effortlessly.

My Loan Offers

Your Loan Offers, Clearly Explained

See real loan offers from multiple lenders, compare terms easily, and take the next step with complete confidence.

Saarathi Recommendation Engine

Smart Lender Matches Based on Your Profile

Powered by data and similar borrower insights, Saarathi recommends lenders most likely to approve your loan, faster and smarter.

Aapka Saarathi

Ask Questions. Get Answers. Learn from Experts.

Have a loan question? Join the Saarathi community to ask loan-related questions and get trusted answers from financial experts and experienced partners.

Saarathi AI

Your Personal AI Loan Expert

Ask SaarathiAI anything about loans, eligibility, credit, or documents — and get instant, guided answers you can trust.

Saarathi Bazaar Dashboard

Your Loan Marketplace, All in One Place

Compare loan products, track loan Requests, and discover the best offers tailored to your profile, effortlessly.

My Loan Offers

Saarathi Recommendation Engine

Aapka Saarathi

Saarathi AI

Saarathi Bazaar Dashboard

Your Loan Marketplace, All in One Place

Compare loan products, track loan Requests, and discover the best offers tailored to your profile, effortlessly.

My Loan Offers

Saarathi Recommendation Engine

Aapka Saarathi

Saarathi AI

Recognised for Trust, Scale & Impact

Our journey is backed by industry recognition and trusted partnerships that reflect our commitment to transparent, customer-first lending.

received over 100+ awards and recognition

Our Latest Insights

Try Saarathi AI