How AI Is Transforming Loan Approvals in India in 2026

|

Artificial Intelligence is no longer a future concept in Indian lending. In 2026, AI-driven loan approvals are already reshaping how borrowers access credit, cutting approval timelines from weeks to minutes. From instant eligibility checks to personalised lender recommendations, AI is making borrowing faster, fairer, and more transparent. For Indian consumers and MSMEs who value speed, clarity, and choice, this shift is transformative. At Saarathi.ai, we have observed that borrowers using AI-enabled platforms are up to three times more likely to receive suitable offers without repeated rejections. This article explains how AI is transforming loan approvals in India in 2026, what it means for borrowers, and why digital marketplaces like Saarathi.ai are becoming the preferred way to apply for loans.

The Traditional Loan Approval Problem in India

For decades, loan approvals in India relied heavily on manual processes and rigid rulebooks. Borrowers had to submit stacks of documents, visit bank branches multiple times, and wait endlessly for updates. Credit decisions were often binary and opaque. A small mismatch in income proof or credit history could lead to outright rejection, even if the borrower was otherwise eligible. MSMEs and self-employed individuals suffered the most because traditional underwriting struggled to assess variable income patterns. According to guidance and reports from the Reserve Bank of India, improving credit access while maintaining responsible lending has been a key policy priority. AI has emerged as the most effective way to balance speed, scale, and risk.

What AI Means in Loan Approvals

AI in lending is not just about automation. It involves machine learning models, data analytics, and predictive algorithms that analyse thousands of data points in real time. Instead of relying only on static factors like CIBIL scores or salary slips, AI systems evaluate cash flow trends, spending behaviour, repayment patterns, and risk signals. This enables lenders to make nuanced decisions rather than yes-or-no judgments. In 2026, AI has matured enough to support end-to-end loan journeys, from discovery to disbursal, without compromising compliance or borrower trust.

Instant Eligibility Checks and Pre-Approved Offers

One of the most visible impacts of AI is instant eligibility assessment. Borrowers no longer need to guess whether they qualify for a loan. AI engines assess eligibility within seconds based on profile inputs and verified data. At Saarathi.ai, the Saarathi AI expert helps borrowers understand eligibility upfront, reducing rejection anxiety. This approach saves time and protects credit scores by avoiding unnecessary hard inquiries. Many users now see pre-approved or near-approval offers even before uploading documents, a major shift from traditional banking.

Smarter Credit Scoring Beyond CIBIL

CIBIL scores still matter, but AI-driven lending in 2026 looks beyond a single number. Alternative data plays a crucial role, especially for first-time borrowers and MSMEs. AI models analyse bank statements, GST filings, digital payments, and even seasonal income cycles. This holistic view enables lenders to approve borrowers who were earlier considered high risk. At Saarathi.ai, we have observed that self-employed borrowers with moderate credit scores often receive competitive offers when AI evaluates their full financial picture. This is expanding credit inclusion across India.

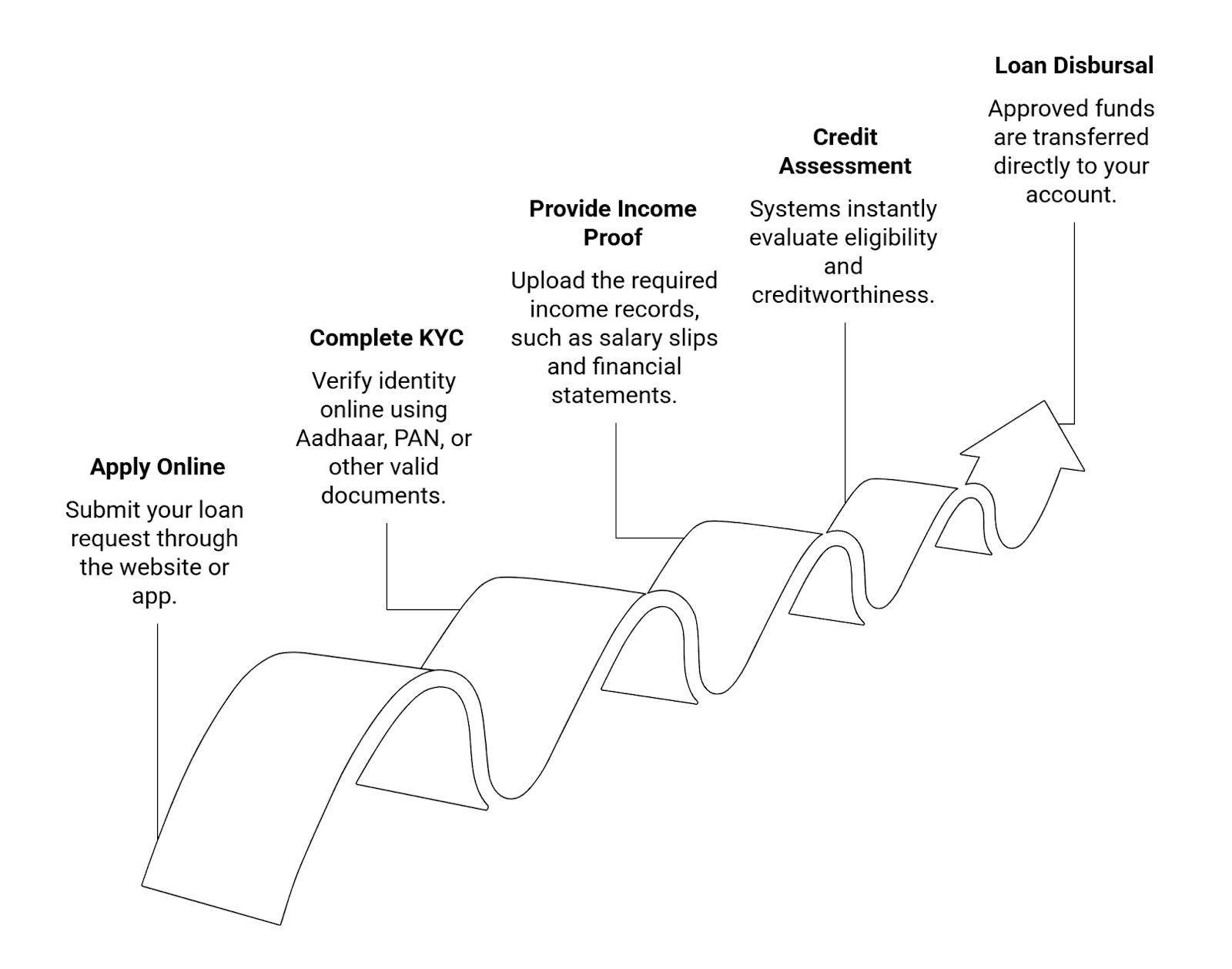

Faster, Paperless Loan Journeys

AI has accelerated the move toward paperless lending. Optical character recognition, document intelligence, and automated verification have reduced manual checks. Borrowers can upload documents digitally, and AI systems validate authenticity in real time. Aadhaar-based eKYC and API integrations with banks further streamline the process. In 2026, many loans are approved and disbursed within 24 to 48 hours. Saarathi.ai supports fully digital journeys, allowing borrowers to track progress transparently through the Saarathi Bazaar dashboard.

Personalised Lender Matching Through AI

One of the biggest frustrations for borrowers is comparing dozens of loan offers with different rates, fees, and terms. AI solves this by matching borrower profiles with the most suitable lenders. Saarathi Recommendation Engine analyses borrower needs, risk appetite, and lender criteria to recommend relevant offers from 110+ banks and NBFCs. This personalised matching increases approval probability and ensures borrowers are not pushed into unsuitable products. In 2026, this level of customisation is becoming the standard expectation rather than a luxury.

Reduced Bias and More Transparent Decisions

AI is helping reduce human bias in lending decisions. While no system is perfect, well-trained models rely on data patterns rather than subjective judgments. Regulators encourage transparency and explainability in AI models to ensure fairness. Leading digital platforms provide clear reasons for approvals or rejections, empowering borrowers to improve their profiles. At Saarathi.ai, transparency is central. Borrowers can see why certain offers are recommended and how changes in income or tenure impact EMIs.

AI and Risk Management for Lenders

From the lender’s perspective, AI enhances risk management. Predictive analytics help identify early warning signals and prevent defaults. This allows lenders to offer competitive interest rates without increasing risk exposure. According to industry insights published by CRISIL and covered by Economic Times, AI-led underwriting has reduced non-performing assets in select digital portfolios. This efficiency ultimately benefits borrowers through lower rates and faster approvals.

Impact on MSMEs and Small Businesses

MSMEs are among the biggest beneficiaries of AI-driven loan approvals in India. Traditional models struggled with fragmented financial records. AI systems can analyse GST data, invoice histories, and transaction flows to assess creditworthiness accurately. In 2026, many MSMEs secure working capital loans within days, enabling them to manage cash flow and scale operations. Saarathi.ai connects business owners with lenders that specialise in MSME financing, ensuring relevant offers and minimal paperwork.

Compliance, Data Security, and RBI Oversight

AI-driven lending operates within a strong regulatory framework. The Reserve Bank of India continues to issue guidelines on digital lending, data privacy, and customer consent. Responsible platforms prioritise data security, encrypted systems, and explicit user permissions. Saarathi.ai follows RBI-compliant processes and works only with regulated lenders, ensuring borrower trust and safety remain intact.

The Role of Saarathi.ai in India’s AI Lending Ecosystem

Saarathi.ai acts as a neutral digital marketplace that combines AI intelligence with human guidance. Borrowers can ask questions via Saarathi AI expert, compare offers transparently, and track applications in Saarathi Bazaar. The platform does not push a single lender. Instead, it empowers borrowers with choice, clarity, and speed. At Saarathi.ai, we have seen approval timelines reduce by more than 50 percent when borrowers use AI-led recommendations instead of applying blindly across multiple banks.

What Borrowers Should Expect Next

As AI continues to evolve, loan approvals will become even more predictive and proactive. Borrowers may soon receive credit offers based on life events such as job changes or business expansion plans. Voice-based AI assistants and regional language support will further improve accessibility. In 2026, the focus is firmly on responsible, inclusive, and intelligent lending.

FAQs

Is AI-based loan approval safe in India?

Yes. AI-based loan approvals operate under RBI guidelines, with strict data security and consent requirements.

Does AI improve approval chances for low CIBIL scores?

AI does not ignore CIBIL scores, but it considers additional data, which can improve chances for eligible borrowers.

Are AI-approved loans more expensive?

Not necessarily. In many cases, AI helps lenders price risk accurately, leading to competitive interest rates.

How fast can I get a loan through AI platforms?

Many AI-led platforms approve loans within 24 to 48 hours, depending on the product and documentation.

Can MSMEs benefit from AI loan approvals?

Yes. MSMEs benefit significantly due to alternative data analysis and faster underwriting.

Conclusion

AI is transforming loan approvals in India in 2026 by making credit faster, smarter, and more inclusive. Borrowers benefit from instant eligibility checks, personalised offers, paperless journeys, and transparent decisions. For lenders, AI improves risk management and operational efficiency. Key takeaways include faster approvals, better matching, and reduced rejection stress. If you want to experience the future of lending today, discover personalised loan options and compare offers across 110+ lenders on Saarathi.ai with complete transparency and expert guidance.