Co-Lending Models in India: What Borrowers Must Know

|

Co-lending models are reshaping India’s digital lending ecosystem. In 2026, many loans are no longer funded by a single bank or NBFC alone. Instead, banks and fintech platforms partner to jointly offer loans to borrowers. This structure improves credit access, speeds up approvals, and expands financial inclusion. However, borrowers often feel confused. Who is the actual lender? Who sets the interest rate? Who handles repayment or complaints? At Saarathi.ai, we have observed that clarity around co-lending builds trust and improves borrower confidence. This guide explains how co-lending works, what RBI regulations say, and what you must verify before accepting a loan.

What Is a Co-Lending Model?

A co-lending model is a partnership where:

A bank and an NBFC or fintech jointly fund a loan

Risk is shared between entities

Loan servicing may be handled by one partner

Typically, the bank provides a larger share of the loan amount, while the fintech or NBFC manages sourcing, underwriting support, and servicing.

This structure combines:

Bank capital strength

Fintech technology

Faster processing

Wider borrower reach

Why Co-Lending Is Growing in India

Several reasons drive this growth:

1. Financial Inclusion

Banks can reach underserved borrowers through fintech distribution networks.

2. AI-Based Underwriting

Fintech platforms use AI to assess alternative data, helping gig workers and MSMEs.

3. Faster Disbursal

Digital platforms reduce manual paperwork.

4. Regulatory Support

RBI has formalized co-lending guidelines to promote structured partnerships.

At Saarathi.ai, we have observed increased approvals for self-employed borrowers under structured co-lending arrangements.

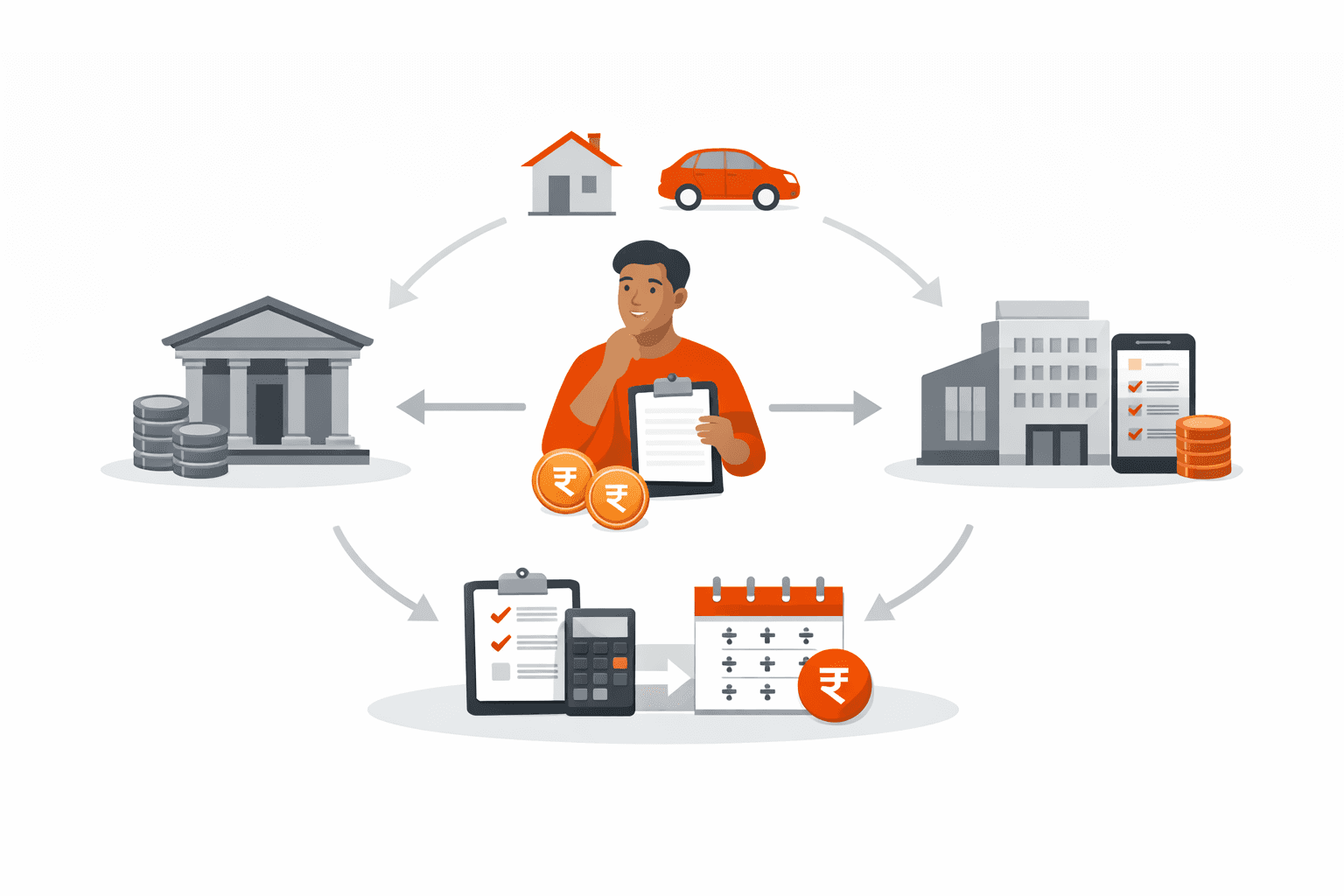

How Does Co-Lending Work?

Here is a simplified structure:

Borrower applies via fintech platform

Credit assessment is conducted

Loan is jointly funded by bank and NBFC

EMI is paid to designated servicing partner

Risk and returns are shared

Even though two entities fund the loan, the borrower experiences a single unified process.

Who Is the Actual Lender?

This is the most common question.

In a co-lending model:

Both bank and NBFC are lenders

Loan agreement must clearly mention all funding entities

RBI requires transparent disclosure

Always check:

Name of regulated bank

Name of NBFC partner

Interest rate breakdown

Processing charges

On trusted marketplaces like Saarathi.ai, lender details are displayed transparently before you proceed.

Interest Rates in Co-Lending

Interest rates depend on:

Borrower risk profile

Loan type

Tenure

Bank and NBFC cost of funds

Sometimes co-lending reduces rates because banks have lower cost of capital. In other cases, pricing reflects shared risk.

You should compare total repayment amount rather than focusing only on monthly EMI.

You can compare personal loan offers on Saarathi.ai to see transparent interest comparisons across multiple lenders.

Benefits of Co-Lending for Borrowers

1. Better Access to Credit

Borrowers in semi-urban and rural areas benefit from fintech reach.

2. Faster Processing

Digital onboarding reduces approval time.

3. Competitive Pricing

Shared funding may reduce interest burden.

4. Inclusion of Non-Traditional Profiles

Freelancers and small business owners get improved evaluation through AI analysis.

Risks and Concerns

Despite advantages, borrowers must remain cautious.

1. Confusion Over Responsibility

Who handles grievance redressal?

Who reports to credit bureau?

The loan agreement should clarify this.

2. Data Sharing Between Partners

Ensure proper consent and privacy compliance.

3. Collection Practices

Recovery must follow RBI fair practice code.

4. Complexity in Loan Statements

EMI servicing partner should provide clear repayment schedule.

At Saarathi.ai, we emphasize transparency and provide borrowers visibility through Saarathi Bazaar dashboard where you can track application status and lender details in one place.

RBI Guidelines on Co-Lending

RBI has laid down key principles:

Formal agreement between bank and NBFC

Clear risk-sharing arrangement

Transparent borrower communication

Proper loan documentation

Reporting to credit bureaus

Borrowers must receive a single comprehensive loan agreement that explains terms clearly.

Co-Lending vs Traditional Lending

Factor | Co-Lending | Traditional Lending

Funding Source | Bank plus NBFC | Single lender

Speed | Faster due to fintech tech | Moderate

Risk Sharing | Shared | Single entity

Borrower Experience | Unified digital | Varies

Access for New Borrowers | Higher | Limited in some cases

For planned long-term borrowing like property purchase, you can compare home loan offers on Saarathi.ai to evaluate both traditional and co-lending options.

Real Borrower Example

Consider a small business owner with moderate CIBIL score but strong GST records.

Traditional bank underwriting may hesitate due to score threshold.

In co-lending:

Fintech analyzes cash flow digitally

Bank funds majority portion

Risk is distributed

Approval chances improve

This demonstrates how technology and capital combine to expand access.

Does Co-Lending Affect Your Credit Score?

Yes.

Repayment behavior is reported to credit bureaus.

Timely EMI improves score

Delays reduce score

Multiple parallel loans increase exposure

Borrowers should monitor credit health carefully.

Before applying, you can ask eligibility questions via Saarathi AI to avoid unnecessary hard inquiries.

Is Co-Lending Safe?

Yes, when:

Both partners are RBI-registered

Terms are clearly disclosed

Data privacy norms are followed

Recovery practices comply with regulations

Always verify regulated entity names in the loan agreement.

Future of Co-Lending in India

In 2026 and beyond, co-lending may evolve with:

Account Aggregator integration

Real-time underwriting

Dynamic risk-based pricing

Deeper MSME penetration

Embedded finance partnerships

The model supports India’s financial inclusion goals while maintaining regulatory oversight.

When Should You Consider Co-Lending?

Good fit for:

MSMEs

Self-employed professionals

Gig workers

Borrowers in Tier 2 and Tier 3 cities

Applicants with moderate CIBIL but strong cash flow

Not ideal for:

Borrowers who prefer traditional branch-based interaction

Complex structured loans requiring customized negotiation

FAQs

1. Is co-lending legal in India?

Yes. RBI has formalized guidelines for bank and NBFC partnerships.

2. Who do I contact for complaints?

Loan agreement specifies servicing partner and grievance officer details.

3. Can co-lending reduce interest rates?

Sometimes, due to bank participation. Compare total cost before deciding.

4. Does co-lending mean higher risk?

No. Risk is shared between institutions, not transferred to borrower.

5. Will EMI be paid to two lenders?

No. Borrower typically pays a single EMI to designated servicing partner.

Conclusion

Co-lending models are strengthening India’s digital lending ecosystem.

Key Takeaways:

Banks and fintechs jointly fund loans.

RBI ensures transparency and compliance.

AI improves access for non-traditional borrowers.

Always verify lender details in agreement.

Comparing options ensures better pricing and clarity.

Before choosing any co-lending offer, compare transparently and understand your terms. Discover personalized loan options on Saarathi.ai today and track your application securely in one unified dashboard.