Algorithmic Bias in Loan Approvals: Fair or Unfair?

|

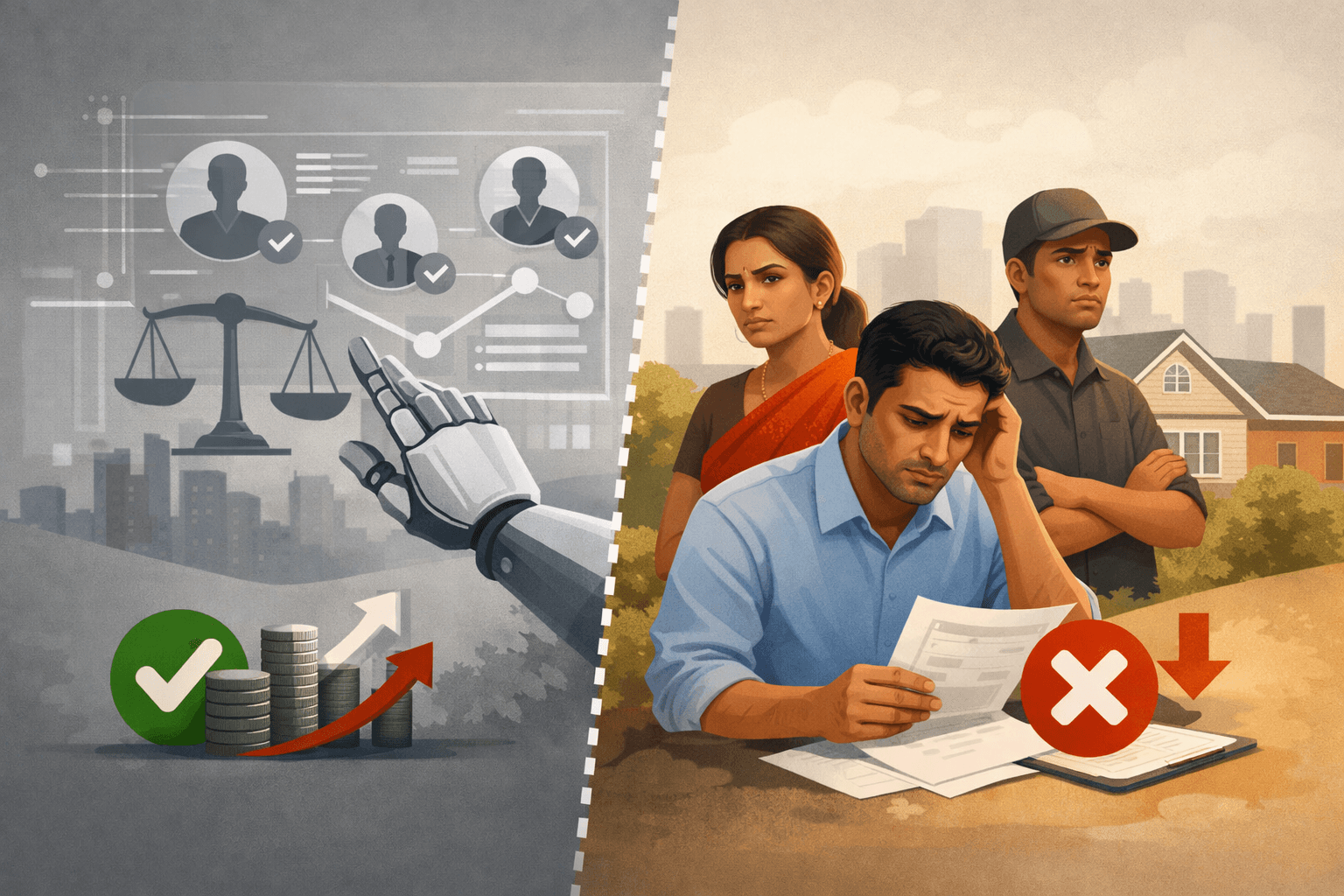

Artificial intelligence is transforming loan approvals in India. From instant eligibility checks to automated underwriting, AI-driven systems now assess thousands of data points within seconds. But a growing concern in 2026 is algorithmic bias in loan approvals. Are AI models expanding financial inclusion or unintentionally creating hidden discrimination? Borrowers often wonder whether factors like location, profession, income pattern, or digital behavior affect approval unfairly. The truth is nuanced. AI can reduce human bias, but poorly designed models may still reflect historical inequalities. At Saarathi.ai, we have observed that responsible AI, combined with transparent lender policies, can significantly improve fair access to credit. Let us explore how algorithmic bias works and what borrowers should know.

What Is Algorithmic Bias in Lending?

Algorithmic bias occurs when automated systems produce unfair outcomes for certain groups due to patterns in training data or flawed design.

In lending, this may mean:

Higher rejection rates for specific professions

Lower credit limits for certain geographies

Stricter scrutiny of gig workers

Disproportionate impact on new-to-credit borrowers

AI models learn from historical repayment data. If past data contains systemic patterns, the model may replicate them.

How AI Loan Approval Systems Work

AI underwriting typically analyzes:

Credit bureau data

Bank transaction history

Income consistency

GST filings

Employment stability

Repayment trends

Credit utilization

Instead of manual review, machine learning models calculate risk probability.

The benefit is speed and scalability. The risk is that hidden patterns may disadvantage certain profiles.

Can AI Reduce Human Bias?

Yes, when implemented responsibly.

Traditional manual underwriting may be influenced by:

Subjective judgment

Inconsistent evaluation

Human error

AI systems apply consistent rules across applicants. This can:

Expand credit access

Reduce subjective decision-making

Improve approval speed

At Saarathi.ai, we have observed that AI-driven matching often helps self-employed professionals and gig workers who were earlier rejected due to rigid criteria.

Where Bias Can Enter the System

Bias may occur due to:

1. Biased Historical Data

If past approvals favored certain income groups, the model may learn that pattern.

2. Proxy Variables

Even if gender or caste is not directly used, variables like pin code or employment type may indirectly correlate.

3. Limited Training Diversity

Models trained on narrow datasets may not represent India’s diverse borrower base.

4. Overemphasis on Digital Footprint

Digitally inactive individuals may be scored lower despite strong repayment ability.

Understanding these risks helps borrowers ask better questions.

RBI and Regulatory Safeguards

The Reserve Bank of India has emphasized:

Fair lending practices

Transparent disclosure of reasons for rejection

Responsible digital lending

Data privacy protection

Audit and governance frameworks

Lenders are expected to maintain explainability in automated decisions.

If your loan is rejected, you have the right to know broad reasons behind the decision.

Algorithmic Bias vs Financial Risk

It is important to differentiate bias from risk assessment.

Not every rejection is discrimination.

Lenders assess:

Probability of default

Repayment capacity

Existing debt burden

Income stability

However, when entire segments face disproportionately higher rejection without clear risk explanation, bias concerns arise.

Responsible platforms must balance risk management with inclusion.

How Algorithmic Bias Affects Borrowers

Borrowers may experience:

Unexpected rejections

Lower loan amounts

Higher interest rates

Additional documentation requirements

For example:

A freelancer with fluctuating income may be flagged high risk despite strong annual earnings.

A borrower from a semi-urban area may receive stricter evaluation due to limited historical data.

At Saarathi.ai, our Saarathi Recommendation Engine works to match borrowers with lenders whose underwriting policies align with their profile. This reduces unnecessary rejections.

Financial Inclusion vs Risk Control

AI has enabled credit expansion to:

MSMEs

Gig economy workers

First-time borrowers

Small-town entrepreneurs

Without AI, many of these segments would struggle to access formal credit.

However, inclusion must be responsible. Over-aggressive lending also harms borrowers.

The goal is balanced and transparent decision-making.

What Borrowers Can Do If Rejected

If you suspect unfair treatment:

Request reason for rejection

Check your credit report

Improve credit utilization

Reduce existing debt exposure

Apply through platforms that compare multiple lenders

Instead of applying randomly across apps, you can compare personal loan offers on Saarathi.ai to find lenders that suit your financial profile.

Transparency in AI Lending

Transparent AI includes:

Clear eligibility criteria

Consistent interest rate disclosure

Defined risk categories

Responsible data usage

Human oversight for edge cases

At Saarathi.ai, we combine AI insights with human guidance to ensure borrowers understand their options.

You can ask eligibility questions via Saarathi AI before formal application to reduce unnecessary hard inquiries.

Real Scenario Example

Borrower A

Salaried employee

CIBIL score 780

Stable income

Borrower B

Freelancer

CIBIL score 720

Strong cash flow but variable monthly income

Traditional models may favor Borrower A automatically.

AI-based models analyzing bank statements may recognize Borrower B’s consistent annual earnings and approve with fair pricing.

This demonstrates how AI can reduce exclusion when designed properly.

Common Myths About Algorithmic Bias

Myth 1: AI always discriminates

Reality: Properly audited AI can reduce human bias.

Myth 2: AI uses social media to judge you

Reality: Regulated lenders focus on financial data with consent.

Myth 3: If rejected once, you are permanently blocked

Reality: Credit profiles change with behavior and repayment discipline.

Ethical AI in Lending

Responsible lenders focus on:

Model testing for fairness

Removing irrelevant proxy variables

Periodic bias audits

Strong governance frameworks

Compliance with RBI digital lending norms

Borrowers benefit when lenders prioritize explainability over blind automation.

How to Strengthen Your Approval Chances

Focus on:

Timely EMI payments

Maintaining credit utilization below 30 percent

Avoiding multiple parallel loan applications

Stable bank balance

Filing GST on time if self-employed

If planning a large financial goal such as buying a house, it is wise to compare home loan offers on Saarathi.ai after ensuring your credit profile is optimized.

The Future of Fair AI Lending in India

By 2026 and beyond, we expect:

Stronger fairness audits

Increased regulatory supervision

Account Aggregator integration

Personalized risk-based pricing

Hybrid AI plus human underwriting

AI will not replace human oversight. Instead, it will enhance consistency and inclusion.

FAQs

1. Can AI discriminate in loan approvals?

It can if poorly designed, but responsible models aim to minimize bias.

2. How can I know why my loan was rejected?

You can request broad reasons from the lender and check your credit report.

3. Does AI use personal data like caste or religion?

Regulated lenders do not use sensitive personal attributes for decision-making.

4. Can I challenge an automated rejection?

You can escalate through lender grievance channels or reapply after improving your profile.

5. Is AI better than manual underwriting?

AI improves speed and consistency, but must be monitored for fairness.

Conclusion

Algorithmic bias is a real concern, but it does not mean AI lending is unfair by default.

Key Takeaways:

AI can both reduce and amplify bias depending on design.

RBI guidelines promote transparency and responsible digital lending.

Borrowers have the right to know rejection reasons.

Comparing multiple lenders improves approval chances.

Hybrid AI plus human review creates balanced decisions.

Choose platforms that prioritize fairness and transparency. Discover personalized loan options on Saarathi.ai today, compare securely, and track your journey digitally with confidence.